Why the Dow Jones Industrial Average (DJIA) is a Terrible Benchmark

By Scott Snider

It’s nearly impossible to tune into mainstream media outlets like CNBC without the Dow Jones Industrial Average (DJIA) being the focal point amongst stock indices. I myself am guilty of quoting the Dow’s price whenever asked how the market is doing. By and large “the Dow” is the default index all of us refer to whenever we talk about the stock market.

It’s interesting because amongst the financial advisor community the S&P 500 is considered the premier US index. Yet, there exists this odd disconnect between what the media reports and what advisors actually believe to be the superior benchmark. With that in mind, it’s time to set the record straight and inform the average investor about what most advisors already know to be true -- the Dow Jones Industrial Average is a terribly outdated benchmark that needs to be put on the shelf.

First A Brief History Lesson

The Dow is a US stock market index that measures the performance of 30 large companies listed on US stock exchanges. It was first created in 1896 by Charles Dow (founder of The Wall Street Journal) and Edward Jones as a way to track the stock performance of the 12 largest industrial companies. It has since evolved to include all 11 sectors of the US economy. Although only 8 of the 11 sectors are currently represented. The Dow is the oldest US index, and for that reason, it will forever continue to be an effective measuring stick for market historians.

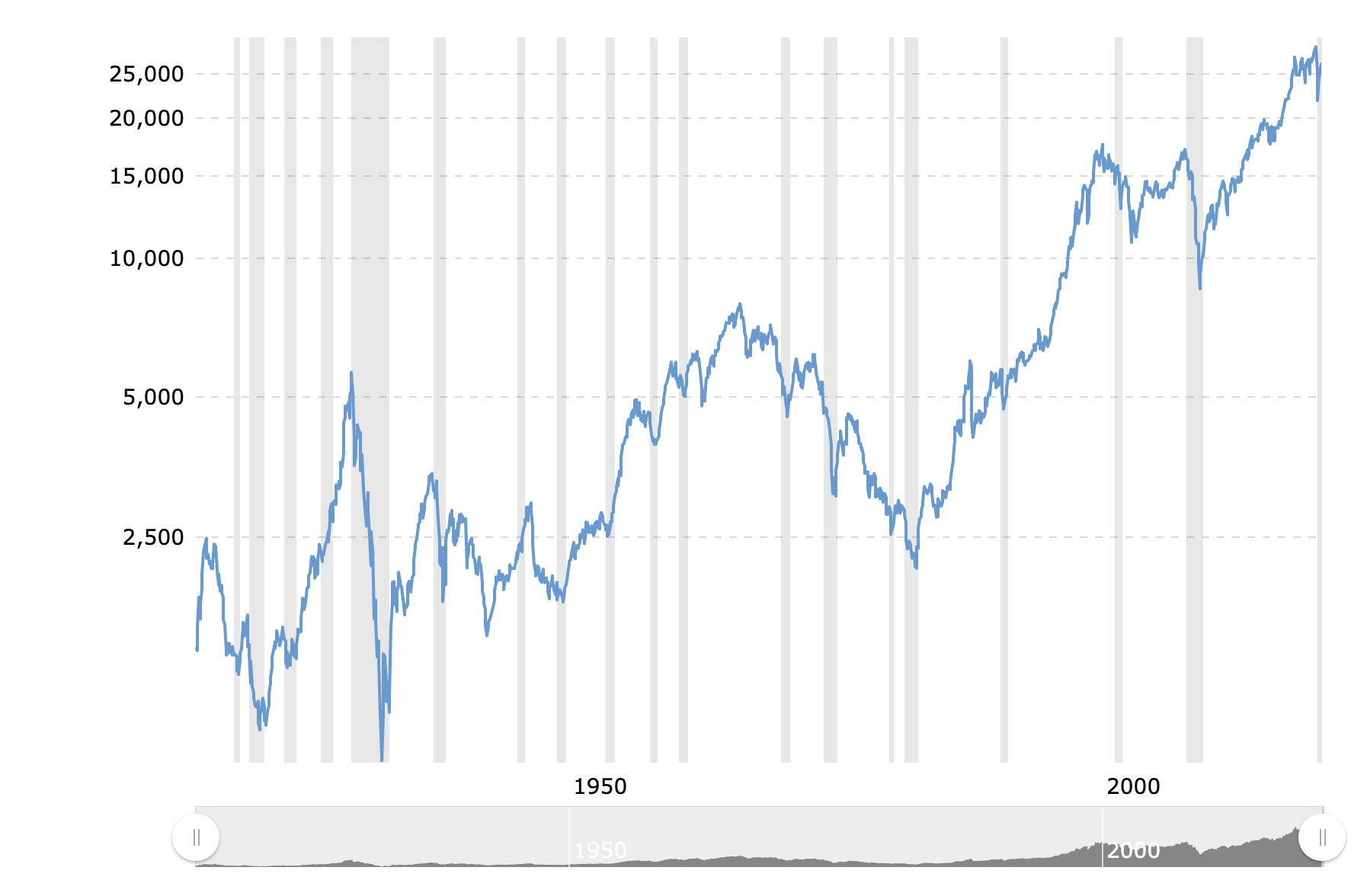

The Dow can also act as a nice way for passive investors to gain exposure to a diversified basket of stocks. Hypothetically speaking, if an investor could directly invest in the Dow index, they would have earned handsome returns over the last 4 decades. The Dow’s closing price to end the month of July in 1980 was 2,915. Fast forward to today and the Dow closed at 26,428 (as of July 31, 2020). In other words, if you invested $10,000 Aug 1, 1980, your account would be worth $80,662 today.

So the issue isn’t whether or not the Dow itself is a useful way for investors to passively make a lot of money in the stock market. The problem is with the fact that the Dow is ingrained in our subconsciousness as the premier benchmark for US stocks, which just doesn’t make any sense if you understand how the index works.

The Dow’s Many Flaws

One of the biggest gripes amongst investment professionals about the Dow is that it only tracks the performance of 30 US companies. Is that really an accurate portrayal of the US stock market? Especially when you consider that there are approximately 3,600 publicly-traded companies on the US stock exchanges.

Surely the size of the company plays a factor, as the 30 companies listed on the Dow are all blue-chip names. However, to be one of the companies included in the index is a somewhat arbitrary process. It’s not even the top 30 companies by size that make up the index. They just need to be large and well-respected companies. Weaker or failing companies eventually get removed from time-to-time. Yet, there is no clear-cut mathematical formula that signals to the index when a company is to be added or removed. Instead, the components of the index are selected by a group of people that work for S&P Dow Jones Indices.

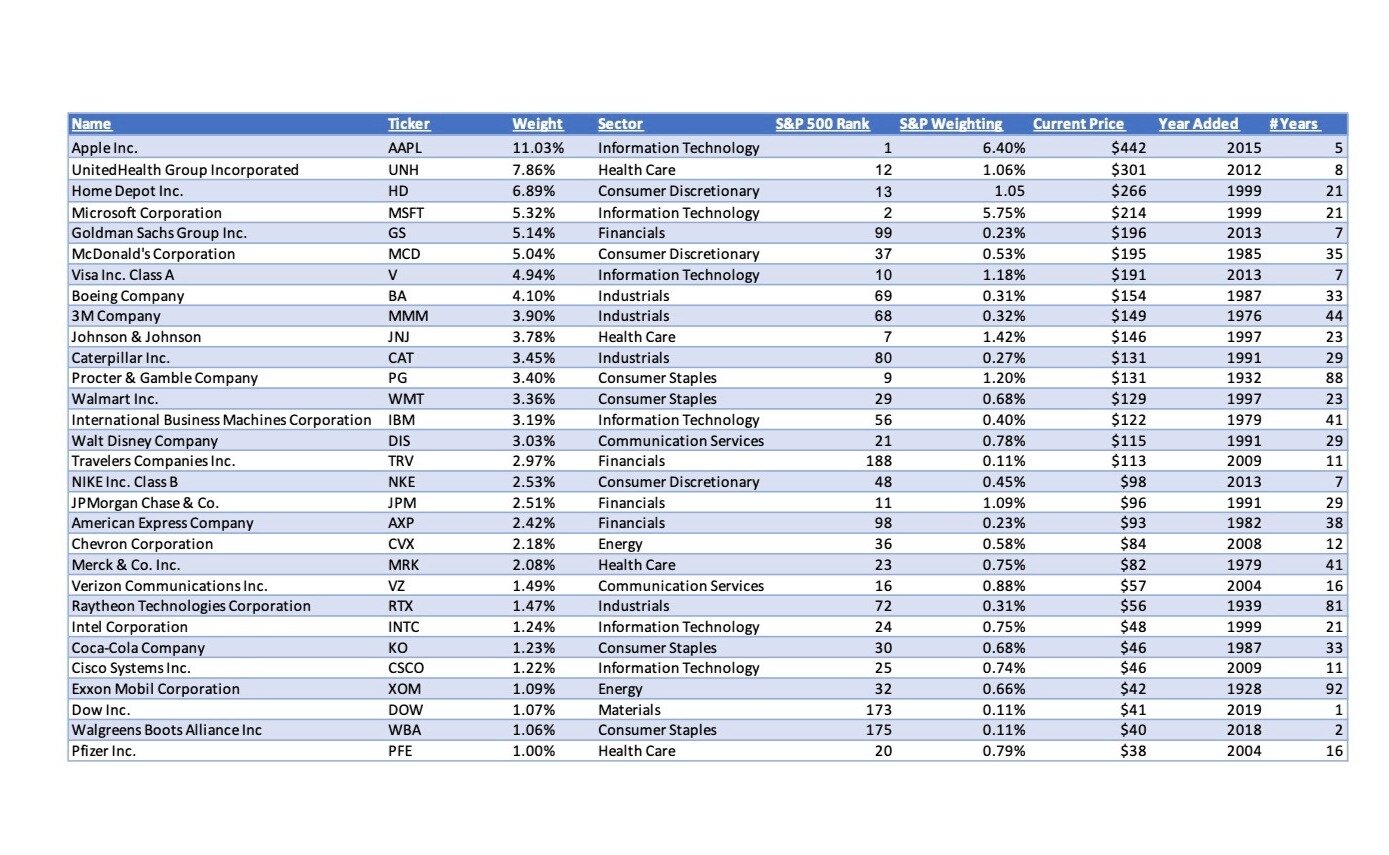

If that process isn’t clear as mud, it only gets better. Instead of using a market capitalized (the actual value of a company) weighted system like the S&P 500, the Dow is a price-weighted index. Price-weighted means that companies with the highest-priced stock take greater weight within the index than those with lower prices. The problem is that higher-priced stocks do not necessarily correlate with a higher value company. Case in point, Travelers Companies is the smallest stock by market cap weight, yet it is the 17th highest ranked component within the Dow due to its share price.

Ranked in descending order, the table below illustrates the contrast between how the Dow components stack up within the S&P 500 index.

A prime example of why the price-weighted method is especially unappealing to investors is that Apple recently announced a 4-for-1 stock split. Currently, Apple sits atop the Dow index as the highest weighted position at 11%, but once its stock splits later in August, it is expected to drop to the 18th highest listing. Investors in the ETF DIA won’t be happy to know that Apple will have less influence on the performance of the Dow. Rightly so, the S&P 500 will continue to have Apple listed as its top holding because Apple also happens to be the largest company in the US by market capitalization. Note that it is a mere funny coincidence that Apple is the top holding in both the Dow and S&P 500.

But wait… There’s more. How can any stock index be considered the most accurate indicator of the US market without including dominant companies like Amazon, Google, Facebook, and Berkshire Hathaway? Hold on a second. None of those companies are listed! If there was ever an appropriate time to use the phrase WTF, it’s in this vein.

Amazon’s exclusion from the Dow has to be the biggest head-scratcher. As the 3rd largest company in the US, Amazon literally dominates our personal day-to-day lives, touches nearly every sector of our economy, and continues to add to their workforce at a time when many are getting laid off from their jobs (cough...Boeing...cough). Instead, the Dow’s most recent additions were Walgreens Boots Alliance in 2018 and Dow Inc (the chemical company not the index) in 2019.

When evaluating those 2 additions from a market-cap weighted perspective they rank as the 175th largest and 173rd largest companies in the US, respectively. Yeah, that makes total sense to me too. Maybe if you name your company after the index your company can get added one day too. Jones Inc., anyone?

I Want the Truth… You Can’t Handle the Truth

If the average investor only knew the truth, they would care less about where the Dow finished the year and leave it up to the financial professionals and historians. 124 years of dominating our mind's eye is a hurdle that seems unlikely to overcome. Inertia is a difficult thing to get around.

Instead, I suspect the Dow will continue to persist as "the market" in popular media outlets for many more years, if not decades. All this despite the fact that the S&P 500 is the far superior benchmark in terms of ranking and sorting the best of best in US business. Therefore, making it a much better indicator of how US business is doing.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Paragon Wealth Strategies, LLC [“Paragon”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Paragon. Please remember that if you are a Paragon client, it remains your responsibility to advise Paragon, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Paragon is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Paragon’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.wealthguards.com. Please Note: Paragon does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Paragon’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Also Note: IF you are a Paragon client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.